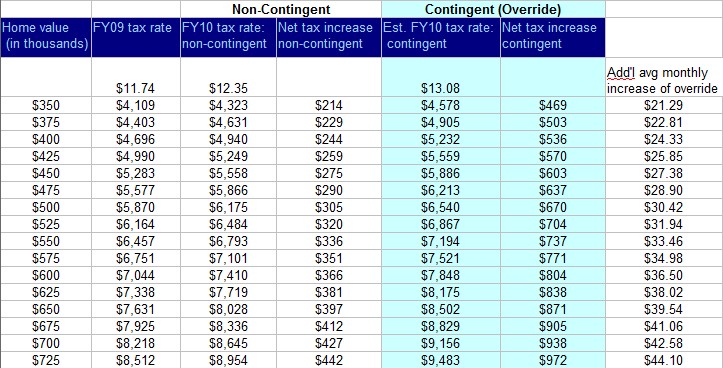

Milton Property Tax table: Impact of contingent and non-contingent property tax increases

Last week Town Meeting passed the appropriations of the contingent budget recommended by the Warrant Committee and endorsed by The Board of Selectmen for various town departments. The budget requires the voters to pass an override to Prop 2 1/2. This election is scheduled for June 8th.

The following table lists the impact that the non-contingent and contingent budgets will have on property taxes and the average difference in the monthly increase.

For example, a house with an assessed value of $475,600 would have an annual increase of $290 with a contingent budget and $637 with a non-contingent budget. The average monthly increase in the contingent over the non-contingent budget for this property would be ~$29.

Tom Hurley, chairman of the warrant committee reviewed this table.

You can learn what your home is currently assessed from the Town Web Site here. You can search for property by address, owner, etc.

Milton Property Tax Table: Override Impact