Commentary by Frank Schroth

I never thought you’d ask. The reason an override is like an avocado is that whether discussing the need for the former or slicing into the latter – you are likely either too early or too late.

There was little to no support for discussing the issue this past fall. The reponse was that it’s too early. We don’t know what we’ll have for “free cash”, department budgets aren’t in place, state aid hasn’t been established.

This despite the warrant committee stating last year that an override would likely be necessary this year.

We entered 2015 without any substantive discussion of an override. Budgets are now established and “free cash” is known. With that information in hand a group of town officials got together on two occasions and decided not to go for an override this year. There were at least two reasons for this. The public won’t support an override because we have $2.9 in free cash and it’s too late! There isn’t enough time to educate town meeting and the public on the need.

So the plan is to take the $2.9 in free cash and ride it, literally for what it is worth, as a bridge to a future override in 2016.

What is free cash (odd term that)?

Free cash is money left over from departments that did not spend down their entire budget, unanticipated revenue that came in higher than expected (e.g. excise taxes), and changes in rates paid etc. You can find a definition from the Massachusetts Municipal Association here.)

There are two Milton myths around free cash. One is that exceptionally high amounts (e.g. $2 million) are one time events and the other is that the money cannot be spent on operating expenses.

In 2013 the amount of free cash was $2.2 million. Officials said we wouldn’t see that high a number again. We did. In 2014 the amount was $2 million and this year it is $2.9 million. Whether these high recurring amounts are a reflection of sound financial management (see MMA definition) or a poor ability to cast financial projections is a separate question.

Some town officials have long maintained that free cash should not be used to fund ongoing operations (see MMA definition). But it is. It happened last year and will occur this year. One official, Selectman Hurley, strongly opposes this but he was outvoted 2-1 by his fellow selectmen. Hurley argues that free cash cannot be counted on year to year. In 2010 free cash was actually a negative number (-$388,072) and in 2011 and 2012 it was just over $500K.

The vote of the selectmen was based in large part on a recommendation of an ad hoc group of officials. The meeting was not public and it is not clear what process was followed. The Warrant Committee was asked to develop a series of budget scenarios and a decision made was to go with a scenario that uses the one time free cash to fund both operations and one time expenses as a bridge to 2016.

One would hope that the consequences of this decision on town departments was clear and done with open eyes and with communication back to department heads to avoid any misunderstandings. Ideally all impacts to every department should be understood by the selectmen who are the final say in whether or not to go for an override. Will all the positions approved by the Selectmen (e.g. police officers, van driver) still be funded? Further, are the risks of deferring an override for a year and the consequences of it failing preferable to the risks/rewards of going out this year?

By deferring a year the town may improve upon the chances of an override passing but our understanding is that the benefit will be diluted as a good portion of any override will need to be applied to cover the one time funds being covered by free cash this year.

Did the process that brought us here have sufficient rigor? Does anyone outside the Warrant Committee have a comprehensive, complete view of this budget and its impact across all town services? Or is the Warrant Committee being required to make Solomonic decisions yet again despite cautions voiced last year?

I am no expert in municipal finance. Maybe everything will work itself out. But don’t say it is too late, that there is not enough time. There was time and we chose not to use it.

This sounds like extremely poor fiscal planning, a likely violation of the open meeting law, and a budget that may have a difficult time finding support at Town Meeting.

I would suggest that there needs to be a full public discussion of the implications of using free cash for operating expenses and how this level of funding will be continued in future years. I also believe there should be an alternative budget prepared for town meeting in the event that the budget with this use of free cash does not pass.

I would think Overrides are like avacados because just like avacados when you get to the center of them it is always the pits more than fruit you are paying for …:-)

Always assuming of course there is any free cash left after the snow and ice costs for this winter are covered.

The winter of 2010-11 totaled 96.8 inches of snow dealt with by the DPW. That winter the snow and ice spending was 706k. We’re already above that total.

Snow removal costs typical run between 5k and 10k per inch depending on the storm. In 2011, the average was around $7,300 per inch. At ~100 inches so far this year, we’re going to be well over 700k and I’d guess that given the nature of the February storms we’re trending closer to the 10k per inch numbers.

As for using free cash for operating expenses. No. A thousand times No. Sure adding free cash to the budgets this year means no cuts, but then the cuts will need to be twice as bad the following year as everyone wants to keep what they had the previous year rather than what they had two years ago.

Having gone through the override process twice on the Warrant Committee, once where there was no BOS backing and again once the impact of the cuts imposed when the override was rejected by the BOS, were clear, it is never too early to begin the discussion. We’ve kicked the can on an override down the path for the last several years and as usual we’re going to end up trying to cram the process in at the last minute and hope that there will be people to lead a campaign.

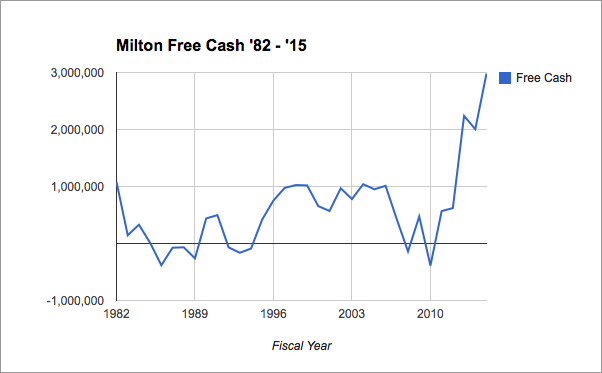

Finally, free cash over 2M is absolutely an aberration. Here are the free cash numbers since FY82 (freely available on the DOR website):

Prior to FY13, in only five years was there free cash above $1M:

FY82 1,080,474

FY83 145,214

FY84 329,111

FY85 10,449

FY86 -381,173

FY87 -74,229

FY88 -66,481

FY89 -261,363

FY90 439,598

FY91 497,700

FY92 -67,729

FY93 -162,220

FY94 -88,103

FY95 423,407

FY96 754,889

FY97 975,601

FY98 1,025,127

FY99 1,019,603

FY00 655,357

FY01 570,981

FY02 968,227

FY03 779,251

FY04 1,039,600

FY05 951,022

FY06 1,011,956

FY07 423,856

FY08 -139,698

FY09 473,754

FY10 -388,072

FY11 568,531

FY12 621,644

FY13 2,238,335

FY14 2,005,200

FY15 2,981,240

Assuming that you will always have 2M available is not a fiscally responsible position to take. Taking FY10 as an example, the WC had a starting estimate in June of 600k for free cash that evaporated to a ~400k deficit by the time the budgeting process started in earnest.

You have to look at the makeup of the free cash amounts each year to determine how likely they are to be really “recurring” Local receipts is the usual source of overages as they need to be conservatively estimated to pass muster with the DOR – you do NOT want to be short on the local receipts estimate.

I took a look back at the FY2012 free cash, of the 2.2M, 500k was from tax foreclosure proceeds and one time reimbursments (so those aren’t recurring). 185k was from funds received in FY12 for FY11 projects (again not recurring). 462k was from Local Receipts coming above estimates (mostly vehicle excise and penalties). 250k was from adjustments to local aid after the budget was passed and 600k was from funds turned back from departments (group insurance and DPW mostly). Funds turned back come in many forms, the usual reason is where departments are unable to fill a budgeted position (for whatever reason) then the unspent monies are returned and go to free cash.

So to recap, of the 2.2M free cash in FY2012, it could reasonably be assumed and budgeted that FY2013 would see a free cash number closer to 700k once all of the one time numbers are removed. I don’t have the break down for FY2013 and 14 but given the numbers are similar I would hazard a guess that it is largely following a similar pattern to that of FY 2012 where there are large sums coming in of one time money.

The TL:DR of this screed? Don’t bank of free cash being this high every year, and for (insert deity of choice)’s ‘s sake don’t spend it on operating budgets.

Sometimes a chart is helpful. Thanks to Mr. Innes for the data.

Thanks to Evan for his research and Frank for the chart.

The average amount of Free Cash is in the $400 -500 , 000 range with mean , interestingly , at about the same.

Here is the problem , free cash is extremely volatile.

For the past three years , we have experienced an unusual amount of free cash. We need to understand the details and why this is happening.

Is it a trend or anomaly, If it is a predictable trend , that should be noted and be part of our budgeting process. If not we need to tread very carefully and be very cautious .

The real danger is that we count on free cash at such a large level that budget accordingly.. That is fine when the money is there , not so good when it isn’t .